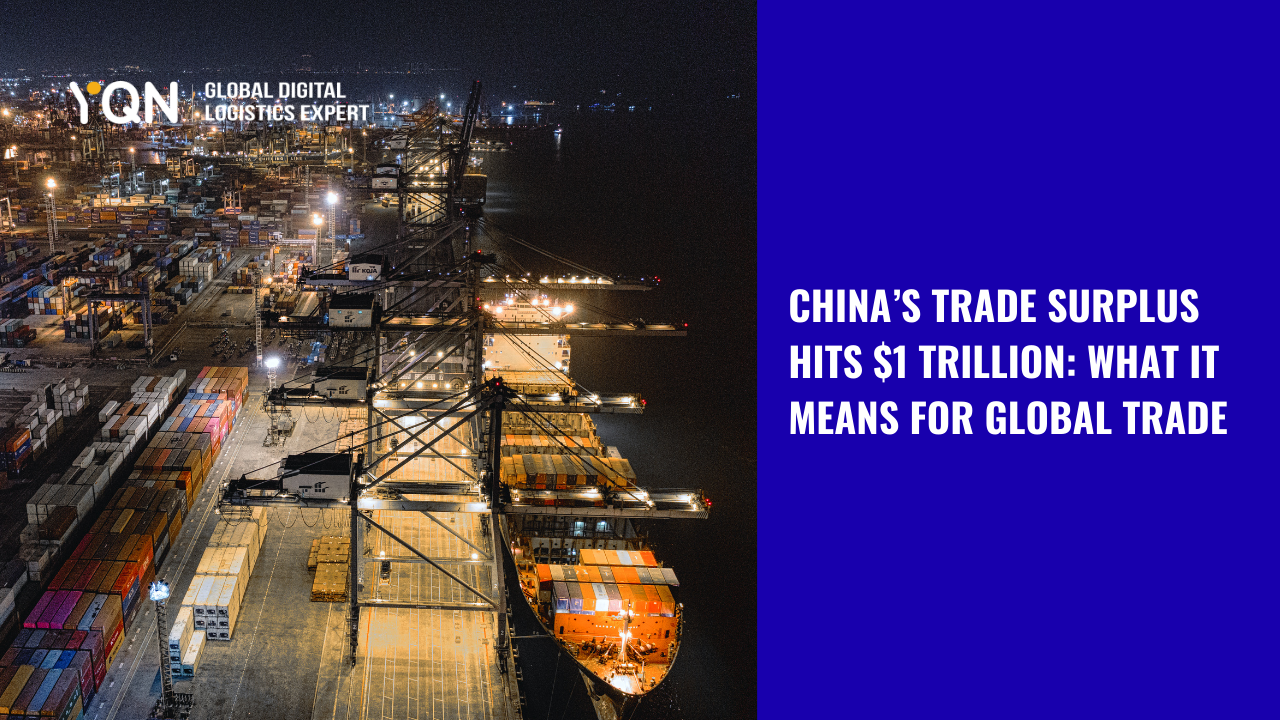

November 2025 Freight Outlook: What’s Shaping Global Ocean Freight

YQN Operation Team | 2025.11.13 | info@yqn.com

As 2025 winds down, the global shipping industry sees both relief and new challenges. Here’s what’s shaping the month for freight forwarding and maritime logistics, and what freight forwarders need to watch in ocean freight news.

1. Typhoons Disrupt Asia’s Supply Chains

Late October into early November 2025 saw two successive typhoons wreaking havoc across Asia. Typhoon Kalmaegi struck the Philippines and later Vietnam, leaving at least 114 dead and hundreds missing, with infrastructure damage, power outages, and transport disruptions in key export regions. Just days later, Typhoon Fung-wong made landfall in northern and central Philippines with winds up to 185 km/h, displacing over 1.4 million people, knocking out power for millions and severely impacting ports and manufacturing zones.

These back-to-back storms have interrupted container flows and trucking around major Asian hubs, increasing the risk of equipment shortages and pushing short-term freight rates higher as forwarders scramble for alternatives.

Why This Matters for Logistics & Global Trade

Asia’s coastal manufacturing and export hubs—particularly in the Philippines, Vietnam, and southern China—are critical links in global supply chains. When typhoons disrupt ports, roads, and rail, lead times rise and shipping space tightens, elevating ocean freight costs and delaying downstream logistics. For freight forwarding companies, this means planning for schedule volatility and potential surcharges.

2. U.S. and China Pause Reciprocal Port Fees for One Year

In a joint move to ease tensions, both the U.S. and China agreed to suspend their previously announced U.S.–China port fees on each other’s vessels for one year, effective November 10, 2025. The original measures, which were set to begin in mid-October, would have added substantial costs to ships owned, built, or operated by entities from either country. The pause is seen as a temporary diplomatic step to support trade stability amid ongoing negotiations on maritime and industrial cooperation.

Earlier, the U.S. had planned to impose port entry fees on vessels built, owned, or operated by Chinese entities under its Section 301 investigation. In reaction, China announced retaliatory “special port fees” on U.S.-linked ships starting October 14, 2025, charging up to CNY 400 per net ton and scheduled to rise in subsequent years.

Why This Matters for Logistics & Global Trade

According to Reuters’ report, the port-fee dispute was estimated to involve about US$3.2 billion in annual fees on large Chinese-built vessels entering U.S. ports, and the suspension removes this cost over the next year. Freight forwarders and carriers specializing in China–U.S. trade lanes are likely to experience more predictable cost structures and fewer sudden surcharges, improving planning and route stability in the near term. Nonetheless, because the suspension is temporary (12 months), companies should remain vigilant—any re-imposition of fees or structural changes in shipbuilding policy could quickly re-introduce cost and routing volatility.

3. Suez Canal in Talks with Carriers on Route Return

The Suez Canal Authority has engaged with major shipping lines to explore a full return to the Red Sea–Suez route, which had been largely avoided after repeated Houthi attacks on commercial vessels in the Bab al-Mandab Strait since late 2023. These attacks forced carriers to reroute around the Cape of Good Hope, adding roughly two weeks to Asia–Europe transits and billions of dollars in extra fuel and insurance costs annually.

According to Egypt’s Transport Ministry, Suez Canal shipping news shows traffic rising 14 percent year-on-year since July 2025, signaling cautious optimism. On 8 November 2025, the container ship CMA CGM Benjamin Franklin, a 399-metre vessel carrying 17,859 containers, successfully transited the canal and the Bab el-Mandeb Strait. A total of 28 medium-sized container ship voyages have been restored since May, indicating major carriers are gradually returning.

Why This Matters for Logistics & Global Trade

A resumption of the Suez Canal route would significantly shorten transit times between Asia and Europe by up to two weeks, lowering route-related costs currently elevated due to Cape of Good Hope detours. For freight forwarding and maritime logistics, this translates into lower ocean freight charges, improved schedule reliability, and reduced reliance on premium routing. However, carriers are expected to wait for sustained proof of route stability, so alternative routing flexibility remains essential.

November brings a mix of relief and lingering uncertainty for global shipping. The temporary U.S.–China port fee suspension and gradual reopening of the Suez Canal offer potential cost savings and schedule improvements, but typhoon disruptions and regional security risks highlight the need for flexible planning. Freight forwarding companies and shippers should continue monitoring ocean freight news and maintain contingency strategies to navigate remaining volatility in maritime logistics.

For more logistics news, scan the QR code and follow us on WhatsApp Channel. If you have any ocean freight inquiry, please contact us at info@yqn.com.